SMEs cautious over alternative finance

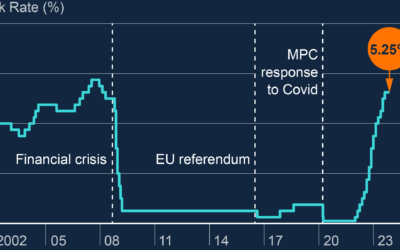

“Research from law firm Walker Morris suggests that a number of smaller firms are hesitant to use alternative finance providers. The poll shows that while 77% of SMEs are unable to secure traditional bank financing, 45% of the 40% with growth plans have concerns about using alternative finance providers. Issues flagged as barriers for SMEs seeking finance from an alternative lender are: concerns over changes in market dynamics and the potential impact on the customer; unregulated lending and potential regulatory loopholes; and higher interest rates and a perception that they are not competitive against bank lenders. James Crellin, director in the finance group at Walker Morris, said: “Alternative finance is arguably the key to helping the economy get back on its feet and grow following the challenges businesses, particularly SMEs, faced during Covid-19.” He added that perceived risks are “based on SME’s impression of alternative lenders and by no means the reality of alternative finance.”

The Fintech Times

Wattsford Commercial Finance are an award-winning commercial finance brokerage that truly work with the whole of the alternative lender market including High Street Banks. Whether you’re a square peg in a round hole, we may well have the right alternative finance solution for your business.